Organisations across the UK health and fitness and leisure sectors are at different levels of maturity when it comes to digital transformation and although they’re making strides, improvements can still be made to enable them to reach a wider audience and reduce inequalities by enabling better access.

UK Active has worked with Sport England, the British Chamber of Commerce and a raft of other partners to publish the results of its most recent consultation on digital in its report Digital Futures 2023: The third annual review of the digital maturity and effectiveness of the UK’s fitness, leisure and sports sector. This report provides the fullest picture yet of the sector’s digital status.

About the study

The Digital Futures research programme began in 2021 and participation has doubled each year since, with this year’s sample representing 2,200 sites across the UK serving an estimated 5.5 million customers a year – up from 1,800 last year.

The 2023 consultation was completed by 204 fitness, leisure and sports organisations and saw a 14 per cent increase in the number of private operators taking part, when compared to 2022. Partners included National Governing Bodies for sports and the Active Partnership Network in the UK.

Of the 136 UK operators who took part, 62 per cent were public sector, 26 per cent private and 12 per cent universities. Within the public sector tranche, 55 per cent were trusts and 45 per cent local authorities.

The sample was composed of 76 per cent English, 6 per cent Scottish, 5 per cent Welsh and 1 per cent Northern Irish respondents, while 12 per cent were nationwide operators. 51 per cent had 1-5 sites, 16 per cent had 6-10 sites, 14 per cent had 11-50 sites, 5 per cent had 51+ sites and 13 per cent were NGBs and Active Partnerships.

This year also saw global territories used as a benchmark following a recommendation by PureGym – a member of the Digital Futures Advisory Group – working with AUSactive, EuropeActive, Sport:80 and the GameDay app.

Digital Futures 2023 provides a measure of how well organisations are embracing digital, and highlights the main areas for improvement to digital strategies. It also draws on data from UK Active’s consumer insights work to provide context behind consumers’ preferences that could have an impact on an operator’s digital journey.

The scoring system

A digital maturity and effectiveness score was established based on multiple choice responses from an online survey.

Questions asked in 2023 were identical to those asked in 2022, with the addition of two about emerging technologies and environmental impact.

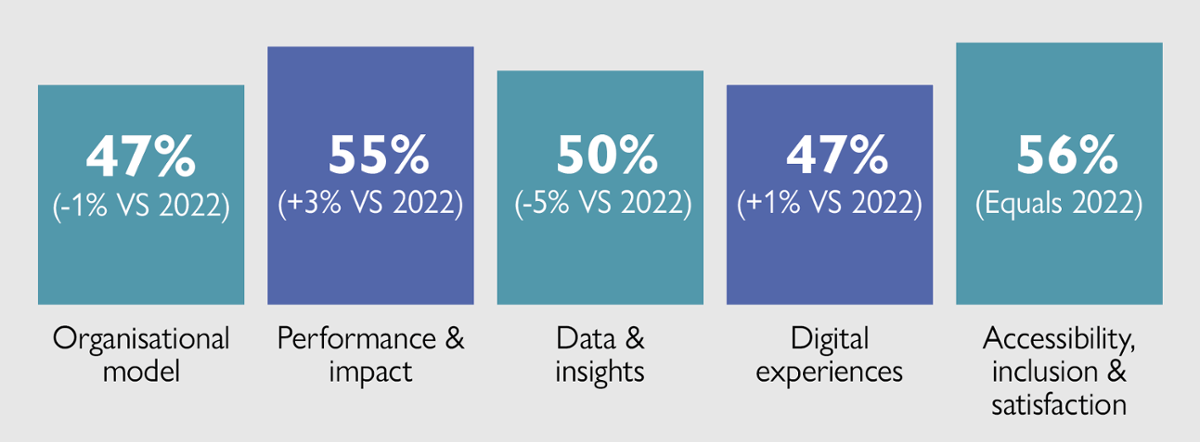

Organisations were asked 40 questions to establish how they engage with digital. These covered five areas – organisational model, performance and impact, data and insights, digital experience and accessibility, inclusion and satisfaction.

The overall scores (health and fitness operators plus other participants) in these five areas in 2023 showed small changes on the previous year, with scores down 1 per cent in the area of organisational model and digital strategy, up 3 per cent on performance and impact, down 5 per cent on data and insights, up 1 per cent for digital experiences and the same year-on-year for accessibility, inclusion and satisfaction (see table 1).

The 5 per cent decline in the score for ‘data and insights’ suggests that with the constant influx of new technologies such as AI, and the increasing volume of data organisations are collecting, some feel they’re falling behind, even if they’ve been progressing in other areas of digital.

Digital Futures categories

The most established category of operators – called the Digital Futures Cohort – is made up of organisations that have taken part in the consultation for two or three years (58 of the organisations that took part in 2021 also participated in 2022, while 28 have completed all three years. See Table 2).

Members of this group continuously outperform the rest of the overall sample. For example, they scored 65 per cent for ‘performance and impact’, which is 10 per cent above the sector as a whole.

Furthermore, 64 per cent say digital accounts for at least half their revenue (compared to 47 per cent of the sector overall) and 97 per cent say they make operational savings through the use of digital (compared to 84 per cent of the sector overall).

Those participating in both 2022 and 2023 increased their score by 4 per cent on average.

Banding operators by performance

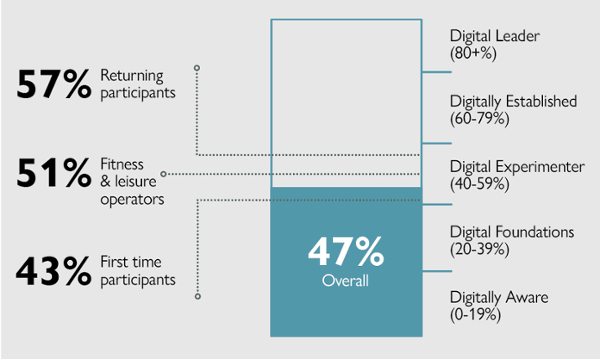

The two- and three-year participants in the Digital Futures Cohort are categorised as either Digital Leaders (if they score 80+) or Digitally Established (if they score 60-79) and together they achieved a digital maturity score of 57 per cent this year (against 53 per cent in 2022).

Five operators reached Digital Leader status – the pinnacle of the digital maturity and effectiveness index – by scoring 80 per cent or more. This compares with three in 2022 and just one in 2021. The highest score was 87.

Being a Digital Leader typically means tech is already driving business performance and setting the benchmark for peers and other companies in the market to follow. However, becoming a Digital Leader isn’t within the scope of all organisations.

One national operator who took part in the survey actually acknowledged it would never reach Digital Leader status, as the complexities of its service offering were preventing it from gaining a higher score. Nevertheless, it still gained from the process, as the programme highlighted that it needed to work on its data strategy.

The index describes those scoring 60-79 per cent as Digitally Established, meaning they’re harnessing digital more than most peers, but have opportunities for greater automation and innovation.

In the next band down, those scoring 40-59 per cent are called ‘Digital Experimenters’, typically meaning they’re making great strides forward, but missing the investment, goal-alignment and rapid advances to yield a really strong performance. Organisations in this bracket scored an average of 51 per cent.

First timers sit in the Digital Foundations (20-39) and Digitally Aware (0-19) categories, scoring 43 per cent on average and when comparing their score with those who’ve participated in all three years, it’s clear this drives progress. The lowest score was 29.

Scores by type and location

Private operators scored highest on average, with 65 per cent attaining the Digitally Established level, trusts scoring 56 per cent, local authorities 54 per cent and universities 53 per cent.

Private operators also scored higher than public operators and universities for most digital categories, but universities scored highest for Data and Insights and matched private operators for Performance and Impact.

As with previous years, organisations with more physical sites scored higher too. Those with 51+ sites scored 64 per cent, 11-50 sites 52 per cent, 6-10 sites 49 per cent and 1-5 sites 45 per cent.

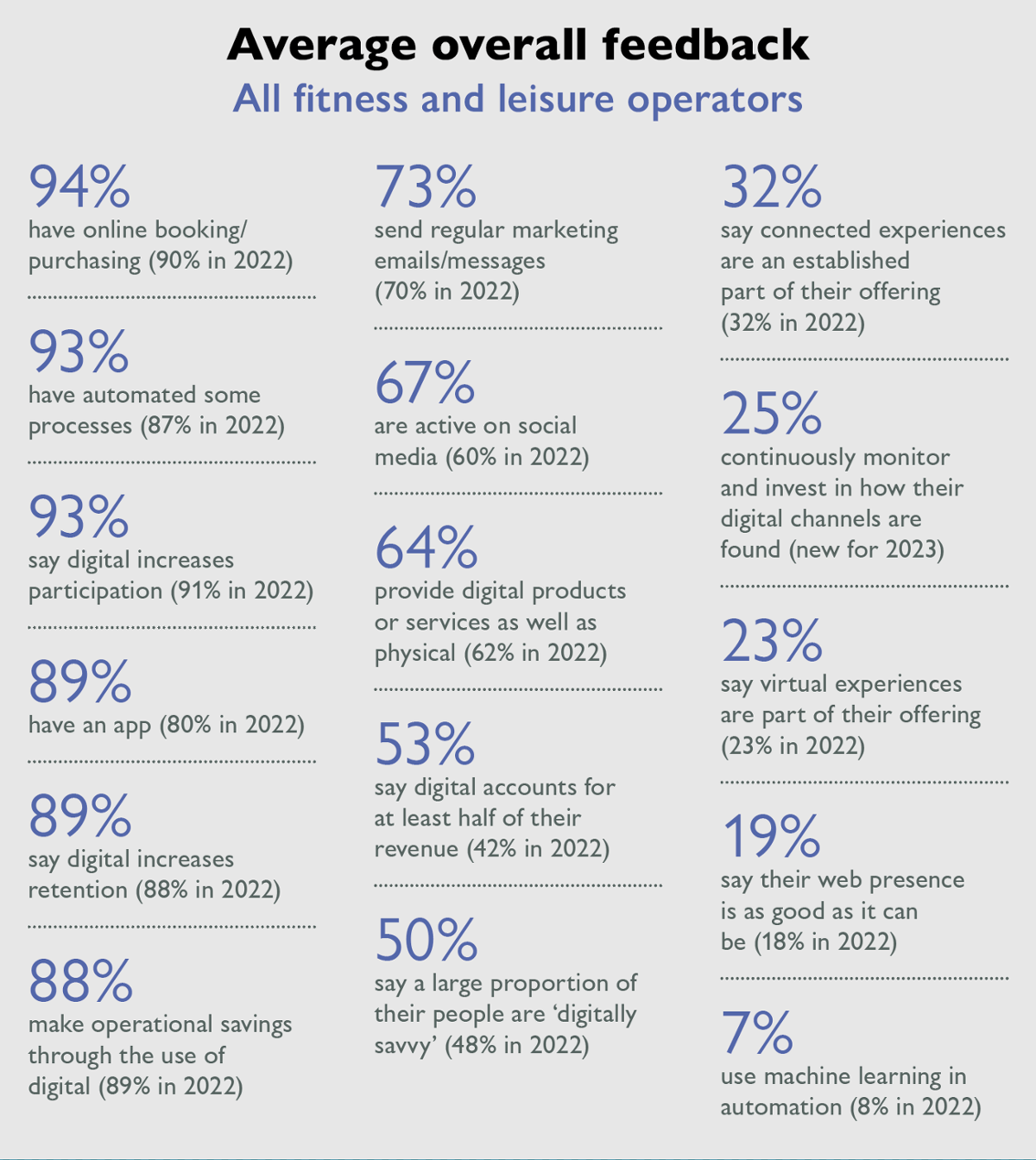

The overall results

The average score for the entire sample this year was 47 per cent across all areas of assessment and each of the organisations that took part also received scores in the individual categories.

This score was four percentage points lower than the previous year, but this doesn’t necessarily mean a drop in digital maturity for the sector as a whole. There have been new participants from inside and outside fitness and leisure and a slightly higher participation from smaller organisations, which tend to score lower.

In addition, the greater the knowledge of digital, the more accurate (and sometimes lower) the score.

The scores for the whole sample for the question ‘Do you have a digital strategy?’ was up 36 per cent on 2022 to 64 per cent, suggesting there’s a more concerted effort to build a digital focus into overarching strategies, although only 20 per cent said they have a digital strategy that’s “up to date, complete, ambitious and supported by a road map.”

This number rose to 43 per cent in the higher-level Digital Futures cohort.

When asked, ‘How does digital influence participation or engagement growth?’ scores were also up by 32 per cent on last year, indicating that investing and using digital processes is having a tangible impact when it comes to reaching and engaging with more members.

However, when asked, ‘What do you do with data you collect from audiences?’ The average score was down by 9 per cent (5 per cent among health and fitness operators), suggesting, as mentioned, that more needs to be done to support operators in using data effectively and the conclusions of the research also highlighted this as a major development area.

Old software

Old systems are still failing some in the sector, with 90 per cent of operators saying at least some of the systems they have hold them back (compared to 84 per cent in 2022).

Legacy systems that don’t integrate seamlessly present a cost and logistical challenge, particularly when multiple systems are required to provide the best experiences and operators are still finding leisure management systems challenging to work with.

There’s a cost and resource impact in changing systems but those who are upgrading to cloud-based versions can better meet consumer needs.

2023 saw the launch of a Digital Futures microsite, which enables software suppliers to support customers in embracing digital transformation, while also allowing operators to see year-on-year views of results with recommendations and resources.

The recommendations

Looking back at the development of the Digital Futures initiative, we see that in 2021, collaboration and simplification were the two key areas of focus – collaboration was about organisations working more closely together with each other, with platform providers and with other third-party providers, such as local authorities, NGBs and Active Partnerships.

Simplification was about reducing complexities, such as the volume of different membership types and products, disparities across different local authorities and multiple versions of platforms.

In 2022, the focus turned to digital maturity and effectiveness, through the introduction of recommendations to deliver organisational excellence and exceptional customer experience.

Three themes emerge in 2023 – data use, inclusion and personalisation.

It’s clear large parts of the sector need more support – even those with higher levels of digital maturity – in the area of data use, where scores have gone down and there’s a significant opportunity to improve inclusivity in ways that would benefit consumers and operators.

Operators need to do more to deliver on inclusion and accessibility to ensure digital transformation doesn’t exclude segments of the population and there’s a need for shared case studies to demonstrate how this can benefit everyone – particularly through the application of personalisation, which can have such a powerful impact on outcomes and engagement.

These themes can only be integrated into an operator’s overall strategy if they’re clearly identified, supported and resourced, but there are huge wins to be had for the sector if this can be implemented, including delivering a competitive advantage, enhancing customer engagement, driving efficiency, fostering agility and promoting data-driven decision-making.

Further reading and insight

Digital Futures 2023 offers tips and guidance to help operators and suppliers establish tailored solutions to ensure the advantages of digital can be felt across all organisations. You can download it at www.hcmmag.com/DF23.

Dave Gerrish is strategic lead – digital at UK Active [email protected]