I’ve commented many times on how trend data from the Leisure Database shows the industry to have been recession-proof during 1980/81 and 1990/91 and also the crash of 2008/09. However, our reseach has found that the first global pandemic in our lifetime has dwarfed any recession.

Results from our 2022 full audit of Direct Debit members of our entire database of 7,000-plus sites shows this part of the industry overall has already bounced back to somewhere between 2018 and 2019, but as always, the devil is in the detail.

After three months’ work that included over 4,000 hours of research and contact with all health and fitness locations in the UK, The State of the Fitness Industry Report, 20th edition, provides a very detailed, yet mixed picture from around the UK.

The headline figures show a drop in the total number of sites, with a knock-on effect on membership, market value and penetration rate, along with the highest rate of closures in 2020 since records began. This should not come as a surprise, so let me give you the facts.

Re-reading my forward in the State of the Fitness Industry Report 19th edition (2019), nothing could have prepared the industry – that was having a ‘golden moment’ – for the sudden about-turn (www.hcmmag.com/goldenage). There are now fewer sites – down 2.43 per cent to 7,063 – while membership has dropped 4.7 per cent to 9,890,985, market value is down by 4.3 per cent and penetration rate is back to 14.6 per cent, losing one whole percentage point. Closures have doubled in the past two years – we found that 631 sites have closed, with more than 50 per cent of those sites closing in the first year COVID hit, although this has been offset by growth, with 455 new sites opening, leaving a net loss of 176 sites over the 27-month period. [LeisureDB does not survey aggregator or pay-as-you-go activity – Ed]

The way forward

Over the past two years, there have been some alarmist pronouncements on possible closures which didn’t happen and also public statements that said demand was ‘back to normal’, but which also proved unfounded in some cases.

Statements were also made to say how much the industry saves the NHS, but these lack hard evidence. In addition, whatever you think the levels of fitness activity have been, our research has discovered that has been lower.

There’s good news too – some brands have expanded, particularly those in the eye of the media, which is comforting news in these times, while some local authorities and their funding and management partners have also been opening new facilities that are more innovative, energy-efficient and appealing to a wider audience, such as St Sidwell’s Point in Exeter.

In addition, the majority of sites fall into the 70 per cent mid-market bracket – if we use a finance measure, as opposed to a value-for-money criteria. This is a part of the sector that could grow if low-cost operators put up prices to cover their increased costs (see my article in HCM on the size of the mid-market at www.hcmmag.com/midmarket).

If cost of living increases begin to bite, low-cost brands that are able to maintain their value-for-money advantage could gain from consumers needing to reduce outgoings.

More data needed

Now in its third decade LeisureDB has an estimated billion data points that have been built up over time, yielding anecdotal evidence, granular latent demand modelling and lots of trend data.

However, as an industry, we have very little collective knowledge and no aggregated hard data about a whole slew of vital industry metrics that government and other agencies could have related to during the worst days of the pandemic. During the last two years, in which making sense of the numbers became a matter of life and death for operators, the industry had huge gaps in the data it had to share.

The UK Government had hard numbers on age-standardised mortality rates by age and vaccination status, but fitness levels, membership and frequency of visits to facilities weren’t linked to this – for good reason – the numbers would have been desperately unreliable.

There were 10 pre-existing health conditions known to cause COVID-19 deaths – conditions that are not collected or held in a format that could be usefully accessed by health agencies.

The virus hit the oldest hardest, with deaths increasing significantly from 60- to 69-years-of-age to 70-79, then with a big jump for 80- to 89-year-olds and the 90+ age group, however, we have no breakdown to show what percentage of the 10.4 million direct debit members of UK health clubs were in each of these four key age groups, or how they’ve fared during the pandemic so far.

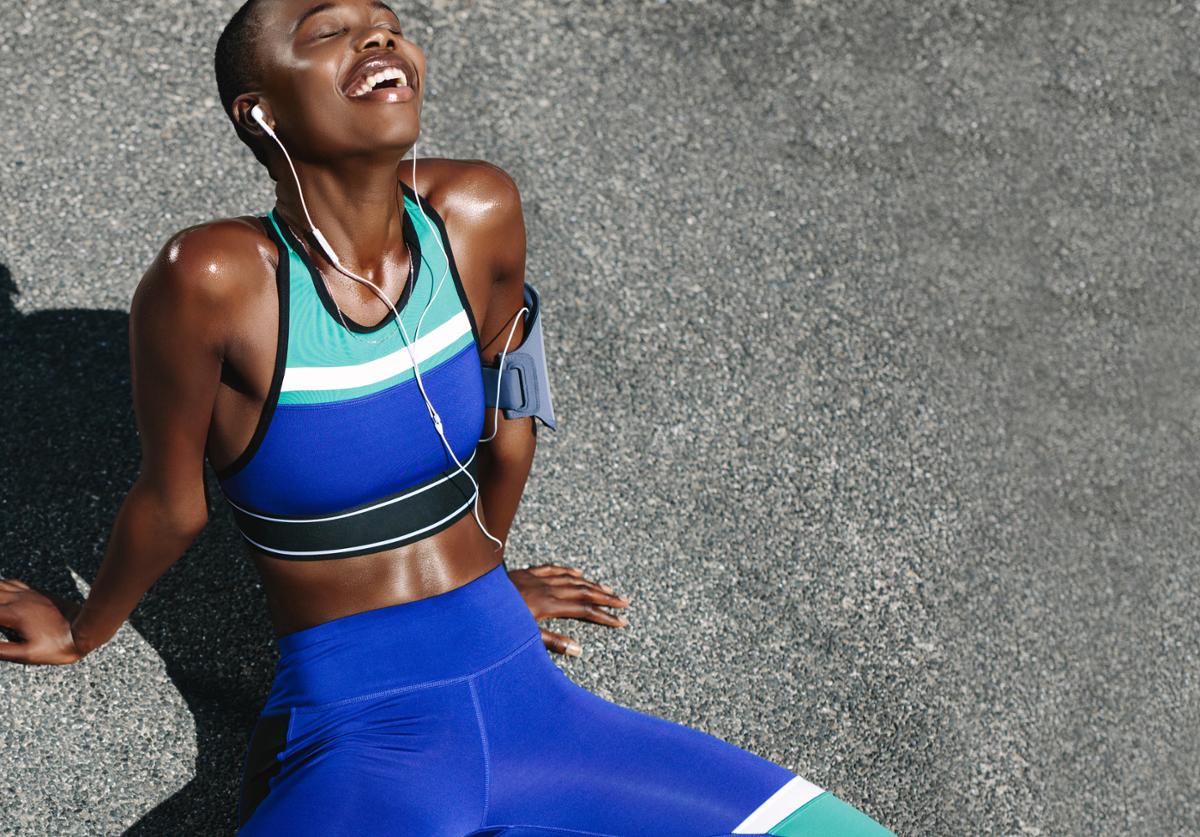

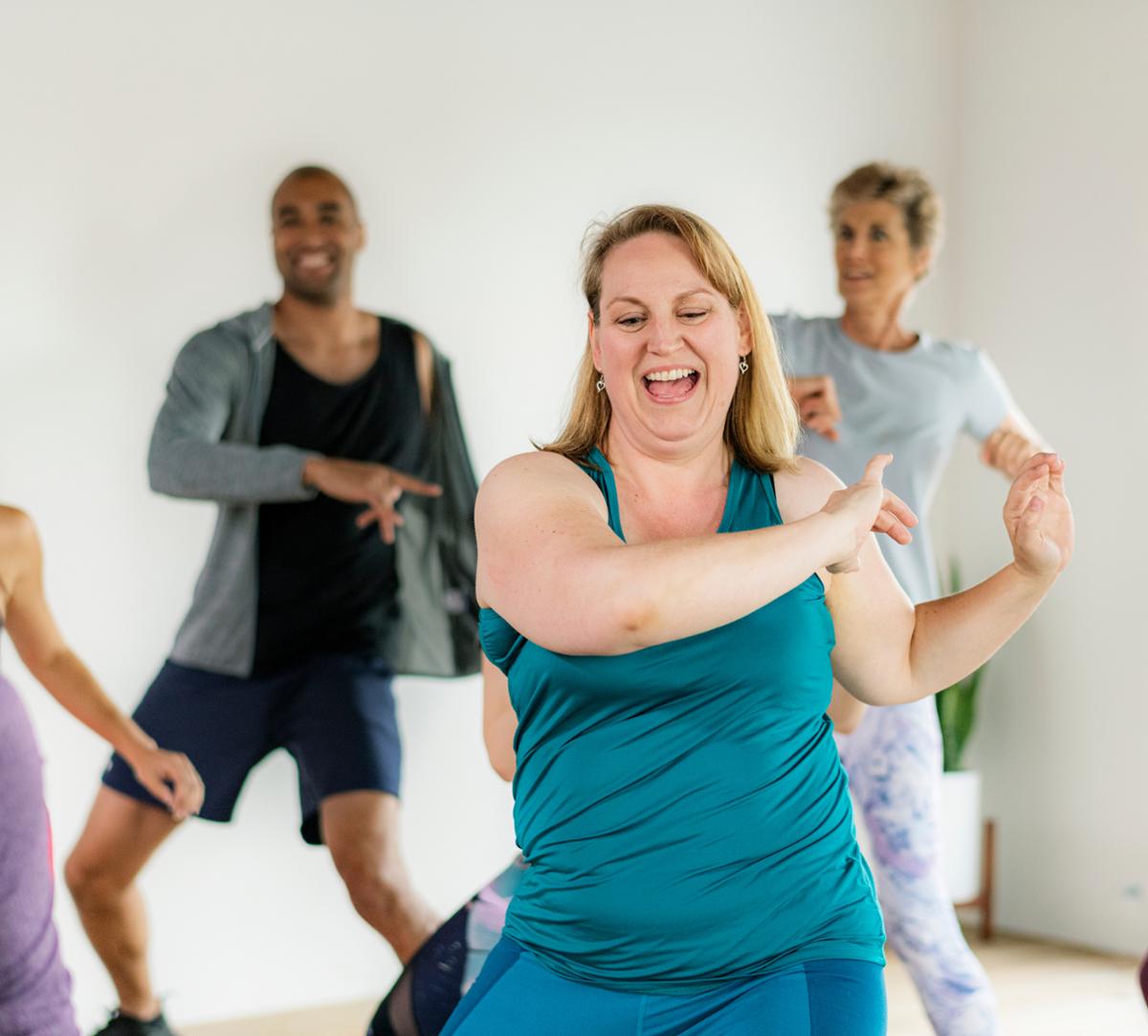

The industry has a role to play in improving the health of the nation, but this future flies in the face of the historical axis of 18 to 35-year-olds and the so called low hanging fruit, known as Gen Z.

To move from the c.14.6 per cent of the population who are touched by the fitness industry through direct debit membership to 50 per cent or even closer to 100 per cent for the industry means a total rethink on product, training, promotion, collaboration with other sectors and also data collection. I sometimes wonder if we need divine help to turn things in a new direction or simply disruption from outside the sector, but it’s clear that major change is needed.

Comparing sectors

There’s increasing competition from outside the fitness facilities sector for the attention of consumers – last year over a billion workouts were logged on the top three fitness channels on YouTube and it’s estimated that fitness workouts on YouTube, TikTok, Facebook and Amazon totalled over 10 billion.

Peloton logged over 200 million workouts in 2021 and has been offering 20 exercise events per month, with 99 per cent of customers renewing their subscription each month.

In line with may other brands, Peloton’s prices are going up – in June 2022 a £5 increase in monthly subscriptions will come in and the company says this has only had a ’modest’ impact on that 99 per cent figure.

Connected fitness providers such as social media channels also know a lot more about exercisers than just their age. And in good times and bad, they continue to be transparent about participation and activation numbers, as their funding depends on it. This transparency continued even though they saw a fall in use after gyms reopened, for example.

Rethinking and resetting

Society rarely has the opportunity to rethink and reset whole industries, but the post-COVID-19 era is being viewed by academics as the greatest paradigm shift in the history of many key sectors. Yet the leaders of the fitness industry – not just in the UK, but worldwide – are trying to persuade governments that the sector can help them reduce costs and save lives without offering any hard data to support this case.

The number of scholarly articles published in relation to rethinking areas such as education, social care, transport, work and the environment, currently outnumber articles on fitness and daily exercise by a million to one. But without academic articles, without the openness and transparency of peer review and without the capacity for experimental evaluation, the fitness sector will fail to make its case.

Governments and private equity investors now have rough benchmarks with which to understand connected fitness, which still has some of the highest customer ratings and lowest churn rates, while even companies such as WW (Weight Watchers) and start-ups such as Fit20 can and do provide evidence of improvements. The fitness industry now needs to prove that regular ‘doses’ of activity can save money and lives, and that people who belong to health clubs on monthly direct debits are fitter and healthier than the average member of society.

The pandemic also ensured that the industry’s issues with both sleepers and attrition were suddenly out in the open for all to see, and we now need to be more transparent about the starting points for understanding our sector when it comes to age breakdown, monthly activity events, improvements in strength, flexibility, balance and cardio among individuals.

More change needed

The industry has a choice on how it uses the post-COVID ‘mixed dividend’. Understanding the ‘dose’ of activity needed to address individuals’ personal needs is mandatory. Upskilling of front line staff is a given.

Closer links to integrated services will show how our industry can dovetail with a market for healthy movement which is ten times bigger than ours.

In 2020/21 the fitness industry was not fit for purpose, but hey, in 2008 the banking sector wasn’t either. Bigger industries learn from their mistakes and failings and my huge levels of in-built optimism convince me that the fitness sector will do the same – particularly if there are enough counter-argument against the current thinking.

The positives to come out of the pandemic include a greater level of interest in health among consumers, and a commitment to a common prosperity policy by government and in my article on active ageing for HCM (www.hcmmag.com/Mintonageing), I’ve already shown how the industry can double in size over the next few years as a result of these macro trends.

In our fourth decade, members of The LeisureDB team intend to collect more data, more often, to aid this collective knowledge and the ‘measurement of effect’ for our wonderful sector. We believe it’s important we do this in normal times, so we can play our part in times of need.