Building on a strong performance in the leading markets, the global health club industry posted solid growth in 2013 – that’s the topline finding of The 2014 IHRSA Global Report: The State of the Industry, which was published by IHRSA last month.

While economic growth remained uneven among global markets, the health club industry expanded as top markets recorded good results. Growth was particularly strong for economic leaders in the Americas, Europe and Asia. Overall, the global health club industry generated US$78bn in revenue in 2013, and more than 160,000 clubs attracted nearly 140 million members worldwide.

The following is excerpted from the Industry Research section of the report.

The Americas

In the US, the health club industry posted growth in revenue as well as number of club locations and memberships. While revenue and club count increased modestly, membership rose significantly. More than 54 million Americans belonged to a club, up 8 per cent from 50.2 million members in 2012. Revenue grew to US$22.4bn from US$21.8bn in 2012, while club count increased to 32,150 from 30,000.

According to The IHRSA Canadian Health Club Report, club operators serve nearly six million members at roughly 6,000 facilities in Canada. Results from IHRSA’s Canadian health club survey show that, although a sample of clubs posted marginal revenue growth of 0.5 per cent from 2011 to 2012, growing consumer interest in non-dues revenue services may fuel future growth. Based on the OECD’s Better Life Index, Canada ranks high in measures of wellbeing, providing club operators and developers with an ideal marketplace for health and fitness offerings.

In Latin America, Brazil continues to show strong performance as the leading health club market in the region. Also a global leader, Brazil’s revenue totals more than US$2bn from over 30,000 clubs with 7.7 million members. The IHRSA Latin American Report shows that opportunities for growth lie ahead in Latin America, as member penetration rates remain low in comparison with more developed markets.

Europe

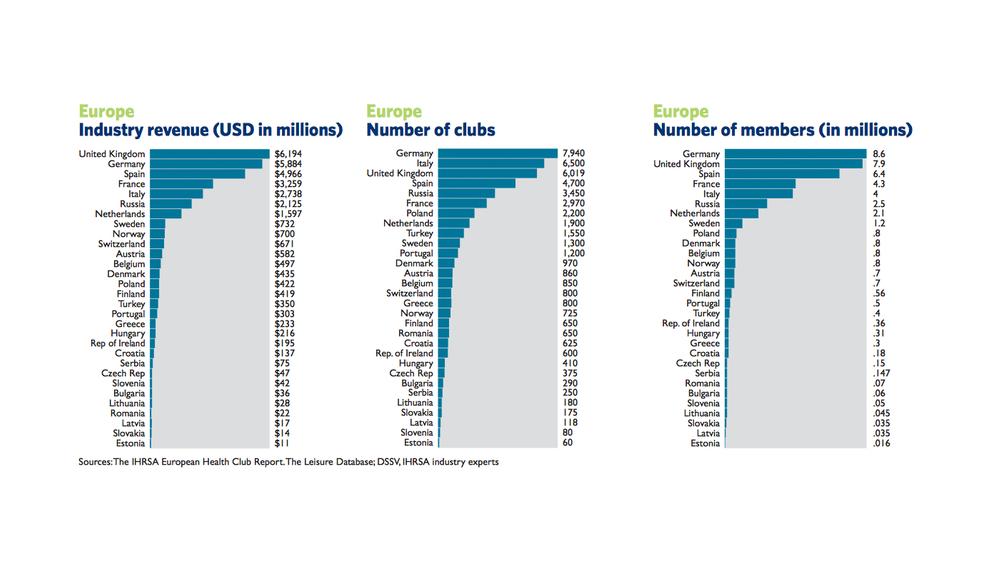

The IHRSA European Health Club Report shows that 44 million members belong to more than 48,000 health clubs in Europe, producing annual revenues of US$32.9bn.

The European health club market is the most profitable region observed, maintaining the greatest number of clubs and generating the most revenue. Although Ireland, Greece, Portugal and Spain have struggled in recent years, the markets in Germany, Norway and Poland have shown growth.

Based on primary research conducted by DSSV (Deutscher Sportstudio Verband), the number of clubs in Germany rose by 4.9 per cent in 2013 as revenue climbed by an impressive 12.1 per cent. The number of memberships grew by 8.1 per cent and now roughly 8.6 million Germans are health club members. The health club landscape is shaped by a variety of club models: traditional full-service centres, women-only franchises, medical/wellness facilities, low-cost clubs, microgyms and more.

The health club industry in Norway and Poland is also strong. One in four Norwegians aged 16 and older belongs to a health club. Norway generates roughly US$700m in revenue from 725 clubs with 800,000 members. The economic downturn had minimal impact on Norway.

Among emerging markets in Europe, Poland is the health club industry’s leader. The Polish health club market brings in US$421m in revenue generated from a total of 2,200 health clubs, which maintain some 800,000 memberships.

Asia Pacific

The Asia Pacific region serves 17.4 million members at nearly 22,000 health clubs. Health club industry revenue totals US$13.8bn in this region, led by the rapidly growing economies of China and India. Japan is also an industry leader, with a handful of the top 25 global club companies headquartered there.

According to the AASFP China Fitness Club Industry Report, the number of members in China grew by nearly 8 per cent: more than 4.8 million people now belong to a health club. The number of club locations also increased by 3.5 per cent in 2013, with the Chinese fitness industry now comprising more than 3,000 health clubs. In Hong Kong, some 600 clubs attract 15.1 per cent of the city population as members.

In India, the economy grew by 4.5 per cent between 2012 and 2013. Although this rate represents a decline from recent years, the Indian economy remains strong and awareness of health and fitness continues to grow. Preliminary estimates show that health club revenue grew by 5 per cent, totalling US$535m in 2013. Roughly 440,000 members belong to 1,200 health clubs in India.

In Japan, roughly 4 million members belong to 3,500 health clubs, which altogether generate estimated annual revenues of US$5bn. Japan is home to three IHRSA Global 25 industry powerhouses: Central Sports, Konami Sports, and Renaissance. These three health and fitness operations combined generated roughly US$2bn in revenue during 2013 – approximately 40 per cent of the Japanese industry’s total revenue.

Future prospects

Looking ahead, the health club industry’s potential for growth looks promising. Supported by existing strong economies and improving global markets, club operators and developers will continue to attract consumers as global awareness of health and physical activity grows.