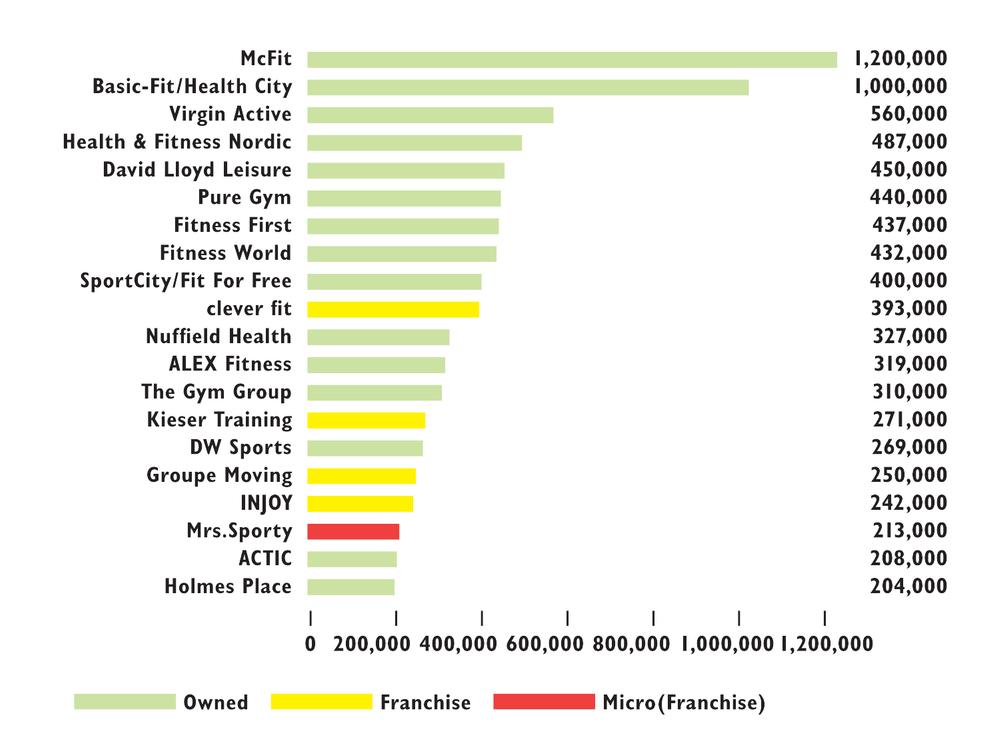

In the 2014 edition of Leading Operators - Fitness in Europe, the top 20 fitness chains accounted for around 8.2 million members – an increase of 6 per cent, or 500,000 customers, on the previous year. On average, the top 20 operators had almost 2,400 members per club at their 3,400 facilities.

To be part of the top 20, operators needed at least 204,000 members in total across their estate at the end of 2014; for a place in the top 10, 400,000 were required.

Although growth of the leading chains was driven by a number of acquisitions in 2014, it’s interesting to see that the overall composition of the top 20 remained almost unchanged compared to the previous year, with only one new entrant on the list – Actic Fitness.

In addition, the rankings remained relatively stable, with only low-cost operators such as clever fit and Pure Gym able to achieve significant improvements in their ranking: UK-based low-cost provider Pure Gym achieved the biggest change, moving from ninth to sixth place. After the opening of 30 facilities in the UK in 2014, Pure Gym’s management is planning a further 30–40 new clubs for 2015. In addition to ongoing growth in its domestic market, the company also intends to expand internationally. For a full interview with Humphrey Cobbold, CEO of Pure Gym, please see p30.

Pure Gym would have made an even greater leap had the merger with its national competitor The Gym Group been allowed to go ahead; it was eventually turned down by the competition authorities in the UK. Together the two companies would have ended 2014 with 750,000 members, which would have taken them to third place in Europe in terms of member numbers.

Meanwhile the leading operator in terms of members remains Germany-based low-cost provider McFIT (see Figure 1), and seven of the 10 largest players are at least partially operating in the low-cost segment. This demonstrates the continued growth and influence of the budget segment.

Top three by members

Looking in detail at specific operators, top of the list McFIT currently has more than 1.2 million people exercising in its facilities in Germany, Austria, Poland, Spain and Italy. Its home market of Germany, with 166 clubs, is by far its strongest region. However, an important step in its international expansion was achieved in Italy in 2014: McFit became segment leader in the Italian market with the acquisition of Italian budget operator HappyFit – 14 facilities in northern Italy.

Basic-Fit / HealthCity realised the strongest absolute increase in memberships in 2014. One year after the entry of private equity firm 3i, the second-ranked company by members reduced the gap between itself and McFIT, reaching more than a million members for the first time by the end of the year. In addition to opening new facilities, in the year since our previous report the company had also continued the repositioning and rebranding of former HealthCity clubs into the low-cost Basic-Fit concept.

The third place also remains unchanged. Although Virgin Active sold a small number of clubs to its British competitor Nuffield Health in 2014, the operator was still able to maintain its position in the top three by member numbers. It’s reported that the company – part of Richard Branson’s Virgin Group – is now preparing an IPO in Johannesburg, evaluating Virgin Active at around €2bn (£1.5bn).

With two acquisitions taking its estate to 150 clubs and 450,000 members, Danish market leader Fitness World moved closer to the top three. First, the company took over its national competitor Fresh Fitness in December 2014, before acquiring club operator Condizione in Poland in January 2015.

“The Polish market seems similar to what we saw in Denmark a few years back. Our ambition is to achieve in Poland what we have successfully done in Denmark, respecting that we are not yet familiar with this market and very aware that there are cultural and structural differences that need to be taken into account,” commented Henrik Rossing, founder and chair of Fitness World, following the transaction.

Mergers & acquisitions

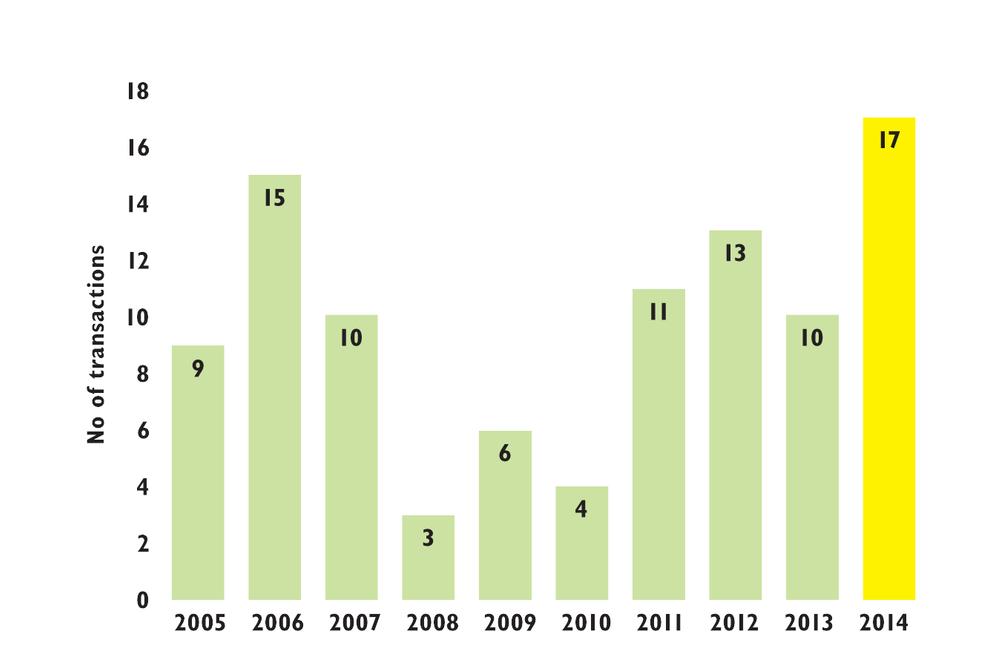

Although one of the largest transactions of the past year could not be closed – the merger of Pure Gym and The Gym Group in the UK, as noted above – the high number of acquisitions in 2014 and the first developments of 2015 confirm the major trends of previous years.

First, the consolidation among the major health and fitness providers in the market continues. Second, the ongoing interest of financial investors in the fitness industry is clear. One of the most recent examples is the participation of private equity company AFINUM in the German high-end operator MeridianSpa in early 2015, following AFINUM’s acquisition of shares in Swiss fitness chain Let’s Go Fitness in September 2014 – the investor’s first entry into the fitness industry.

This investor interest is, we believe, well-founded: the health and fitness industry has grown significantly in the past and we believe it will continue this positive trajectory. Within the market, individual companies also offer great potential for expansion, both through the roll-out of new facilities and the acquisition of existing providers.

Between 2005 and the end of 2014, at least 100 transactions were completed in which health and fitness operators were purchased (see Figure 2). Almost half of these acquisitions took place in the UK, again illustrating the stage of development of the UK market in comparison to the rest of Europe.

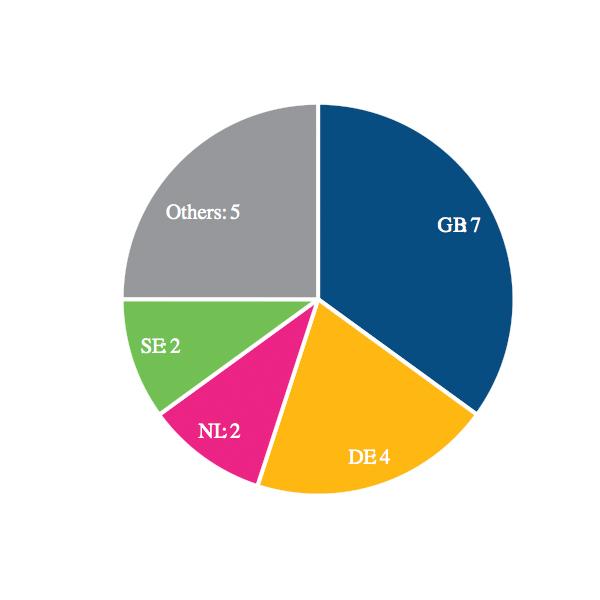

In fact, when we look at the geographical origin of the largest operators, a strong dominance of the United Kingdom and Germany becomes apparent: as Figure 3 shows, seven of the 20 largest providers are located in the UK, while four companies are headquartered in Germany. The only other countries where more than one top 20 operator originates are the Netherlands (two) and Sweden (two).