Average charges for an adult swim session have topped £5.00 (US$6.45, €5.83) for the first time, as expenditure on swimming and swimming lessons reaches record levels, according to the new State of the UK Swimming Industry Report 2023 from market intelligence outfit, LeisureDB.

The finding bears out industry feedback showing that some operators and consumers are accepting the need to charge more for swimming.

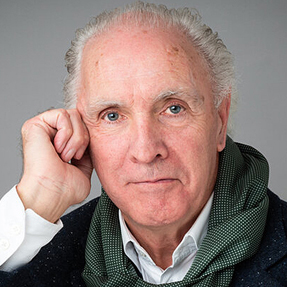

Speaking to HCM recently, Duncan Anderson, CEO of South Downs Leisure, which is managing the new Swim Lanes lido in Brighton UK, explained that swim prices have been adjusted to ‘reflect the true cost of operating a pool’, with rates set at £11 per swim or £50/55/month for membership.

“We needed to charge the correct price at Sea Lanes, to not only fit in with the value proposition of the brand, but also to make it sustainable for the future and to reflect the true cost of operating a pool,” said Anderson.

The right to swim

Speaking to LeisureDB for the new report, GLL founder Mark Sesnan talks about pricing, saying: “Pre-energy crisis, we calculated the actual cost per swim to be around £10,” he says. “Now it’s somewhere between £10 and £15. Meanwhile, we charge customers between £1.00 and £6.00.

“We can’t start charging £10–15 a swim,” says Sesnan. “Swimming is meant to be for everyone. It’s part of the national curriculum. We’re an island nation with a vast inland network of rivers, lakes and canals: it’s important for their safety that everyone can swim.

“We need to wake up and realise that to achieve this, it’s essential that we have good quality pools and a financial model in place that enables public subsidy.”

Freedom Leisure CEO Ivan Horsfall Turner agrees: “Most of the UK’s indoor swimming provision is delivered through the public sector. That’s important to recognise, because you have to look at a public leisure facility as one whole service – a service that delivers physical, mental and social health benefits to local communities, both in the facilities themselves and in the wider local community.

“In that overall service, some products will be higher revenue drivers. Others can and should be subsidised to ensure they are delivered.”

Sesnan adds: “Traditionally, health and fitness was able to subsidise swimming. With pool operating costs rising as they are, that’s no longer possible. Something has to give.

“We’ll be left with fewer pools nationally, and the areas that suffer most will be the areas of deprivation, where there isn’t as much money in the system, and rural areas where there aren’t enough people to justify an intensive programme.”

He concludes: “I believe the future of pools should be much more widely discussed and debated. What is the real need in terms of numbers and types of pools? What should the national provision look like? At GLL we know what works and what is needed, but it’s clear that in many places, councils simply aren’t investing adequately.”

Environmental challenges

Space & Place’s Architects’ Keith Ashton offers a reality check around environmental impact: “There isn’t a sports facility nor swimming pool being designed or built today that isn’t envisaged to still be standing in 2050,” he says. “Yet so much of what our industry is doing right now is not fit for a zero carbon future.

“Across the UK, there are local authorities where over 50 per cent of their total carbon emissions are discharged just through their leisure buildings.

Referencing a recent S&P project – the Passivhaus St Sidwells Point leisure centre in Exeter, UK – that’s achieving a 50 per cent saving on water use, a 70 per cent reduction in energy, and zero in-use carbon, Ashton adds: “This was no ordinary project, yet this approach needs to become ordinary. Quite simply, we must all agree – right now – that sustainability-focused investment today is good for our future.”

LeisureDB also reports on the tech that’s making an impact on the swim customer experience, from AI lifeguarding – which is saving on wage bills while mitigating staff shortages – to online bookings and the invaluable data they provide and learn-to-swim-tracking apps.

The power of swimming lessons

Minton says swimming lessons have proven pivotal in helping pool operators stay open. “What clearly emerges is a huge opportunity to further optimise pool capacities and revenues, with many operators reconfiguring pools and timetables to accommodate more swimming lessons,” he explains, while Marc Jones from Fitronics says: “Demand for swimming lessons is surging, with a huge backlog of children who couldn’t learn during COVID.”

Everyone Active now has 180,000 learn-to-swim students going through its leisure centres every week, while at 1Life, which is now part of Parkwood Leisure, average class levels are at 115–120 per cent of pre-COVID levels.

In the report, 1Life COO Steve Bambury is straight-talking in his view that: “For public leisure centres, swimming is a balancing act. Lessons are where the money is. The rest of the activities, such as casual use and wellness-focused activities, are generally loss leaders.

“With the continued high costs of energy, pool chemicals, staffing and so on, it’s getting to the point that councils – not themselves in a position to financially support us – are willing to allow more flexibility to dedicate more pool hours to lessons, to drive the revenues that ensure pools remain viable and open.”

He adds: “We have to be realistic: having 2,500 kids whose parents pay £30–35 a month for swimming lessons is really the only way for our pools to be viable now.”

GLL shows this may not have to be the case for all operators, however, as in spite of its growing lesson provision and revenues, lessons account for just 50 per cent of its pool-side revenues, with casual swim driving an impressive 30 per cent.

Yet almost universally, operators are looking to maximise learn-to-swim revenues, with some best practice coming from Parkwood Leisure. “We’ve introduced online booking for swimming lessons, including a dedicated automated waiting list facility that notifies a parent as soon as a space comes available in class,” says operations director Alex Godfrey. “For every child who joins a class one day sooner, we drive an additional £1 in revenue.”

Biggest operators

In addition to analysing the price of a swim and the economics of swimming lessons, State of the UK Swimming Industry Report 2023 ranks operators by size, identifying Nuffield Health as the UK’s number one private sector pool operator by number of sites with a pool and GLL in the top spot in the public sector.

In the public sector, an average of 51 per cent of all pools in the UK are managed by a trust, with the figure in Scotland the highest at 67 per cent.

Opportunity for innovation

The report identifies opportunities for the sector to increase revenues by adopting growth tactics. Bethan Laker of The Leisure Experts says: “Currently, the sector lacks the know-how when it comes to turning pool operations into profitable ventures.”

RLSS and Swim England Qualifications board member Helen Bull echoes this, saying: “The industry now needs to do things differently. The current situation reflects a lack of investment and a lack of joined-up action.”

State of pool stock

In spite of concerns about pool closures, the report shows little change in the number of pools operating in the UK, with the total number down only 1.8 per cent in the 12 months to the end of March 2023.

This compares to a fall of 5.1 per cent between 2019 and 2022, indicating that operators are finding ways to keep pools open, even with the pressure of energy prices, although the 5.1 per cent included pools that had not yet reopened following lockdowns, but were likely to, so these numbers are not directly comparable.

“What’s surprising in our 2023 figures is that we haven’t seen a more significant decrease in pool numbers,” says Minton. “There’s been less of an overall reduction in pool stock over the past 12 months than in the year directly following COVID.

However, “High energy costs will undoubtedly cause more casualties,” warns Minton. “It’s important to note that our figures include pools temporarily closed but slated to re-open and the coming 12 months will be critical, as big decisions are made on the future of pools across the UK.”

State of the UK Swimming Industry Report 2023 also includes a breakdown of pool numbers and regional coverage, openings and closures, public and private sector analysis and commentary on trends.

More: leisuredb.com/publications for both the full paid-for report and free Spotlight report. 15 per cent discount with promo code SWIM15 until 30 September 2023